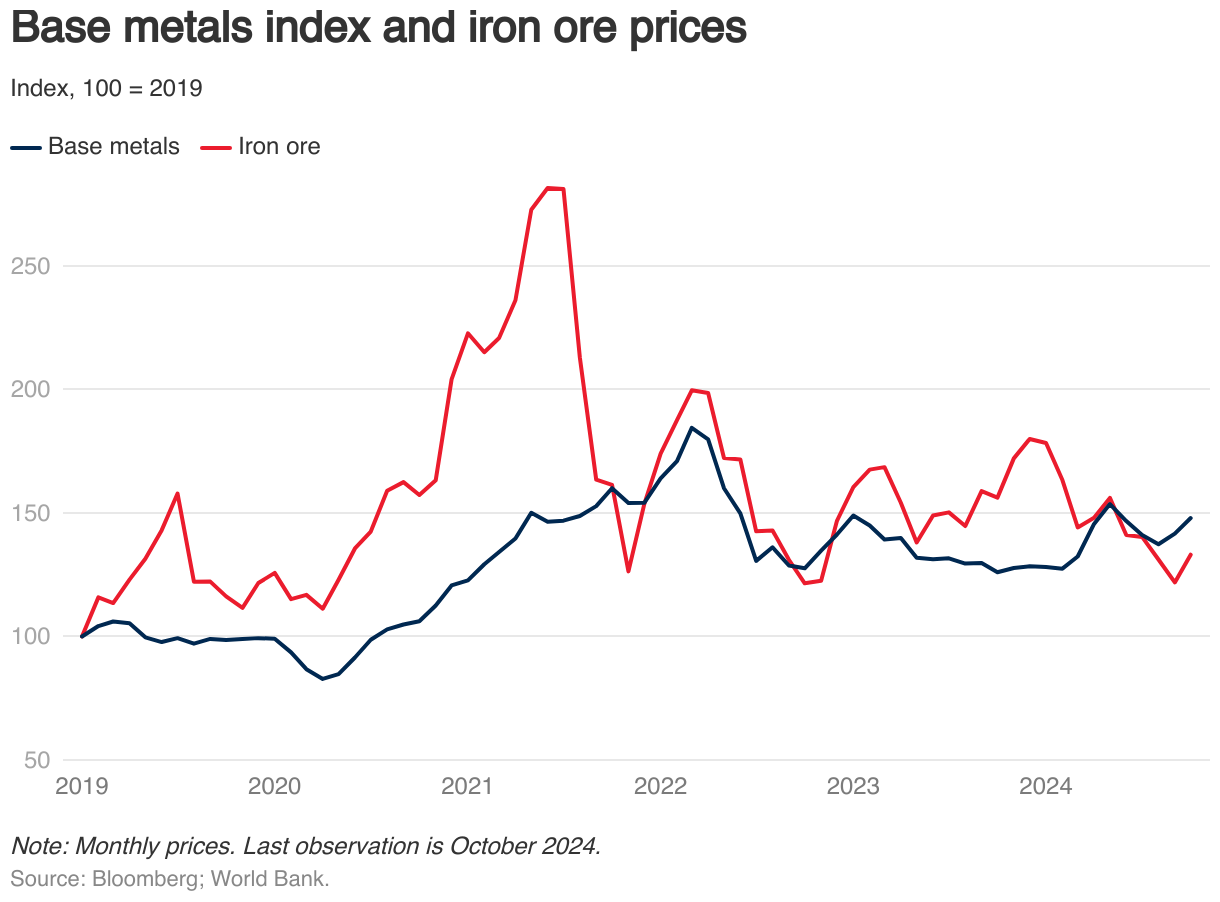

Metal and mineral prices fell by 7 percent in 2024Q3 (q/q), before edging up in October. The decline in 2024Q3 was largely attributed to signs of slowing industrial activity in major economies, notably China, along with increased base metal production earlier in the year. Metal and mineral prices are expected to decline further in 2025 and 2026, after increasing by nearly 4 percent in 2024 (y/y). Key upside risks to these price projections include more concerted stimulus measures from China, including fiscal support, major supply disruptions, and additional trade restrictions. Weaker-than-expected growth in China is a key downside risk to these projections.

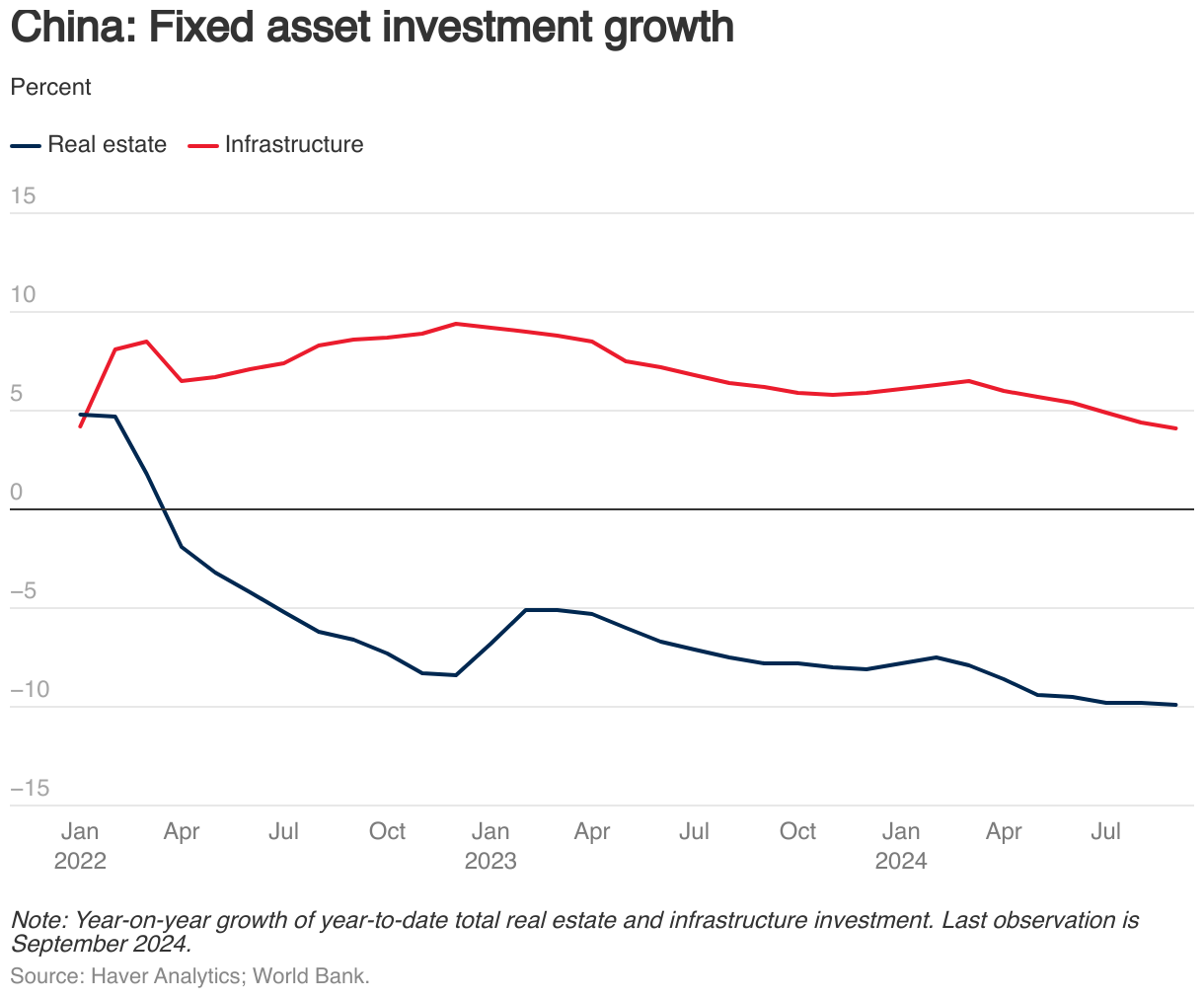

Slowing industrial activity. Global manufacturing activity remained persistently weak in the third quarter of 2024, with global manufacturing PMIs sinking further into contraction territory since July. Subdued economic growth in China—the world’s largest metals consumer—during the same period, alongside further declines in real estate investment, also dampened industrial activity. Some metal prices saw a brief uptick in late September, driven by China’s announcement of stimulus measures to boost growth and stabilize the property sector.

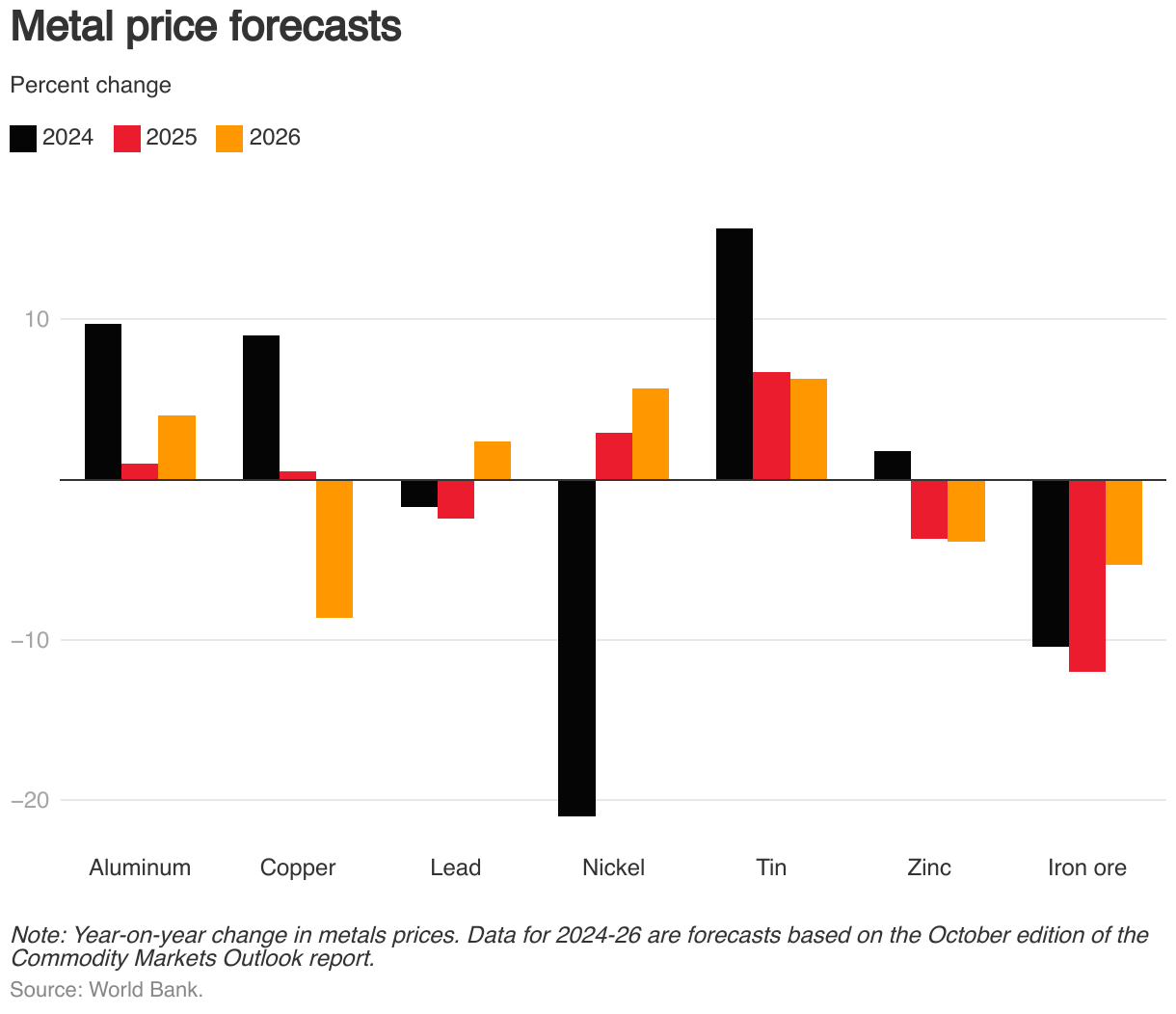

Prices for most metals and minerals are projected to decline in 2025-26. After increasing in 2024, the World Bank’s metals and minerals price index is expected to decline by 0.9 percent in 2025 and 3 percent in 2026. The steepest declines are anticipated for copper, iron ore, and zinc; in contrast, prices for aluminum, nickel, and tin are projected to rise. These projections assume subdued global growth, including in China, throughout the forecast period. Production, however, is expected to improve for some metals, supported by the expansion of mining operations and the gradual recovery of output from major European smelters. Steady growth in iron ore production from Australia and Brazil, the world’s two largest producers, combined with new low-cost production from West Africa expected to come online in 2025, is likely to exert downward pressure on iron ore prices.

The price outlook is subject to several risks. Stronger stimulus measures in China, particularly fiscal support, could drive metal prices above baseline forecasts, especially for metals used in construction. Mining and processing operations may face constraints due to environmental concerns, labor disputes, power and water shortages, or adverse weather conditions. Such disruptions could push prices higher than anticipated. Additionally, the further proliferation of trade restrictions, including new export bans, could reduce the volume of metal production and trade, effectively tightening supply and raising prices above forecast levels. Conversely, a significant downside risk to the forecast is the potential for slower-than-expected growth in major economies, particularly China.